Walid Hejazi is a professor of business economics and international competitiveness at the Rotman School of Management. He recently spoke with U of T Magazine editor Scott Anderson about the economic downturn and corporate bailouts.

We’ve been hearing a lot about this economic slump. How likely is this recession to become a depression? If governments today do what they did after the 1929 stock market collapse, there’s little doubt we would go into a depression. Governments must ensure that banks do not fail so that individuals are able to borrow money to buy autos and homes, and so that businesses can finance operations. U.S. Treasury Secretary Henry Paulson made a strategic error last fall in letting the Wall Street investment bank Lehman Brothers fail – this undermined confidence in the banking sector.

Governments can’t allow protectionism to be seen as a way out. If countries pursue policies to protect jobs, the gains from globalization will unwind and our economy will worsen. Protectionism in the current environment is one of the biggest threats to a smooth and speedy recovery. In the aftermath of the 1929 crisis, the U.S. embarked on a protectionist path that prolonged the global downturn. We must not make this mistake again.

Governments must also act to boost customer and business optimism. This should include fiscal stimulus and bailouts, if needed, for many of the large companies in the economy, such as the automakers. But these bailouts should be linked with commitments from the companies to become more competitive.

Banks seem to get special treatment under these circumstances. Why? Banking is fundamental to the economy. If General Motors were to go broke, it would be terrible, but the bankruptcy would affect particular sectors of the economy. If a major bank goes broke, it affects every player in every sector of the economy. If there’s no confidence in the banking sector, the economy goes into a free fall.

Do you think the American car companies can be fixed for the long term? The Big Three have been losing market share for a long time and haven’t adjusted. They have too many different products, they haven’t focused on their best products, and their cars tend not to be fuel efficient. General Motors is also saddled with 6,300 dealerships in the U.S.; Toyota has 1,500. When GM had 50 per cent of the market this was justified, but not when it has less than 25 per cent. GM would probably like to reduce its dealer network, but it has contracts to uphold. It can’t just cancel them. GM’s pension system is sitting on a multibillion-dollar shortfall. The company also faces significant liabilities for retirees’ health and dental benefits. Retirees are living longer and health-care costs have risen. All of this is problematic for GM because Toyota and other competitors don’t have these same costs. Toyota spends much less on health care and pension costs for every car it sells than GM does.

What about smaller companies that are in trouble and also employ thousands of people? Should they get bailouts? The big players are fundamentally important even to the Circuit Cities of the world, because when a GM goes broke, small companies get hurt, since unemployed people are less likely to buy their products. Governments can provide tax relief or an incentive to assist smaller companies directly. For example, technology adoption rates in Canada are much slower than in the U.S. and the G7 generally. The Canadian government could accelerate the depreciation rate for old equipment. It could put something in place over the next year so that the businesses that do make it through the downturn are more competitive.

Recent Posts

U of T’s Feminist Sports Club Is Here to Bend the Rules

The group invites non-athletes to try their hand at games like dodgeball and basketball in a fun – and distinctly supportive – atmosphere

From Mental Health Studies to Michelin Guide

U of T Scarborough alum Ambica Jain’s unexpected path to restaurant success

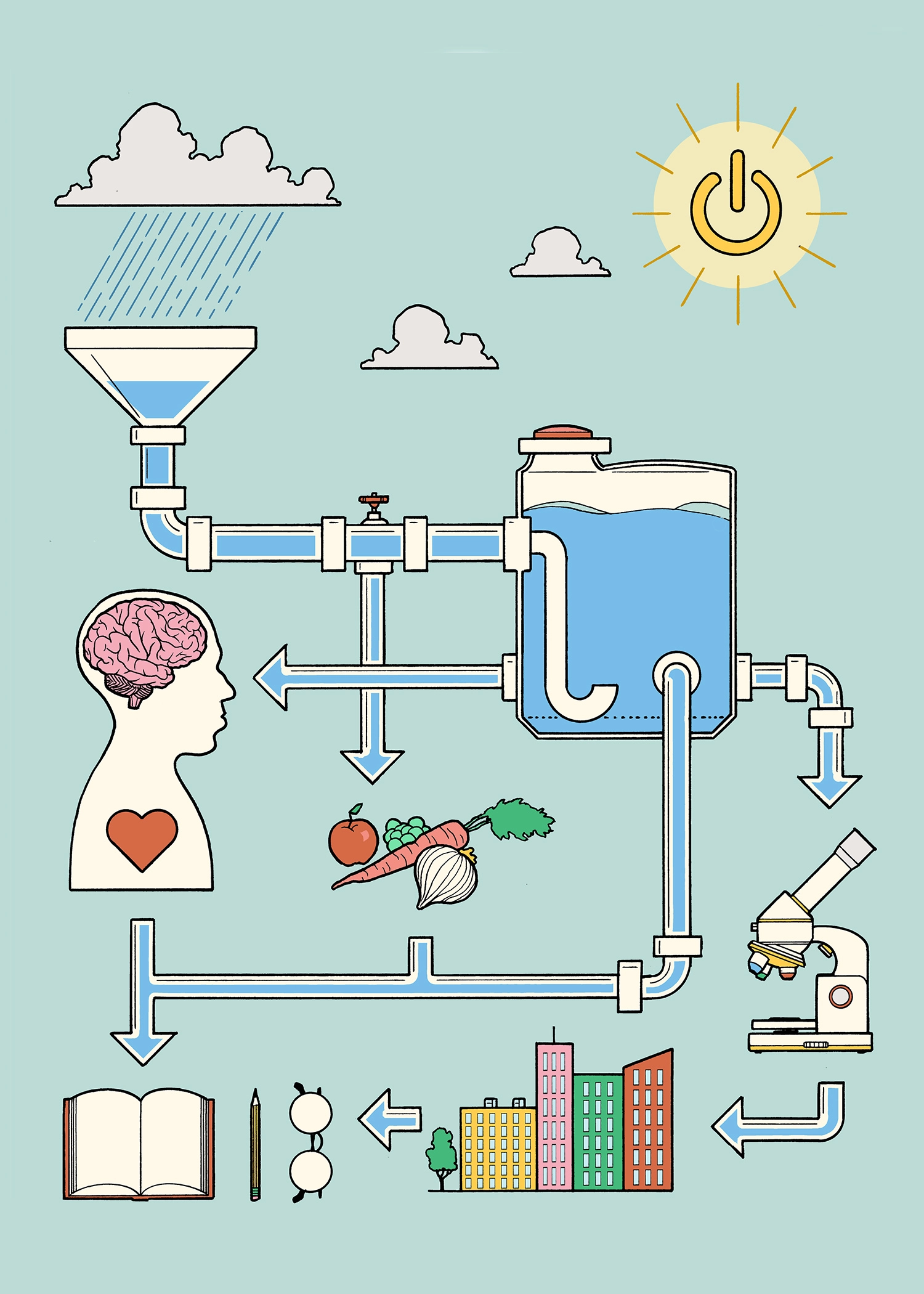

A Blueprint for Global Prosperity

Researchers across U of T are banding together to help the United Nations meet its 17 sustainable development goals