Rotman School of Management finance professor Alan White spoke to editor Scott Anderson recently about the ongoing crisis in credit markets. The crisis was triggered last year by rising mortgage defaults in the U.S.

We’ve been hearing about the credit crisis for a year now. Why isn’t the situation improving? This sort of crisis cannot be resolved until the U.S. acknowledges the problem and takes actions to deal with it. People have lost a lot of money and everyone is reluctant to admit it.

Will people have to fully acknowledge their losses before things turn around? To a large extent, yes. Japan went through a similar real-estate collapse in the early 1990s, and for a decade their banks refused to write off bad loans and start over again with a clean slate. The good news is that Americans are pretty good about taking their lumps. Their banks have already taken about $380 billion in write-downs. But they’ll probably need to take billions more.

Could things get as bad in Canada? No. Our banks don’t take as extreme positions as U.S. banks do and they are more closely regulated. We also have a better regulated mortgage industry.

If American banks were making questionable loans, shouldn’t the regulators have stepped in? An acquaintance who left the U.S. Federal Reserve 10 years ago said they were concerned at that time with the rise of housing prices and the potential for an asset bubble. But regulators are owned by politicians,and as long as things are going well politicians are reluctant to say, “Stop doing this.”

Rating agencies such as Moody’s are supposed to assess investment risk. Yet they didn’t sound the alarm in this case. Is there something wrong with the models they’re using? The people at Moody’s told me that one of the problems in this case is that people were lying on their mortgage application forms – about their income, for example. That’s more of a problem with the assumptions that go into a model than with the model itself.

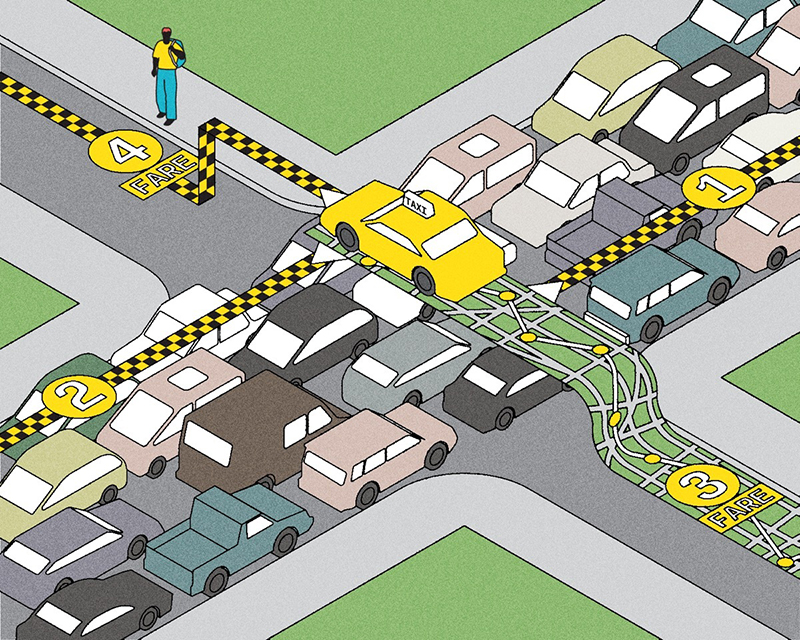

Aren’t the banks supposed to verify that information? That’s normally the case, but there have been major changes in the American mortgage business. The bank used to do it all. Now, a mortgage broker finds the borrowers and gets the bank to take on the mortgages. The bank takes them on and then sells them to someone else. Before you know it the loan has moved halfway around the world. As a result, no one took responsibility for verification.

These crises have been happening periodically for longer than 20 years. Do the principles that govern the financial system need to change? The principles have to do with making rules so people have incentives to behave properly. You sometimes read about a bank, for example, that loses a huge amount of money because an individual did something bad. Then you talk to the people in the bank and they say, ‘Yeah, people knew that the individual was doing something bad and had complained about it, but management said, “Leave him alone, he’s making money.” The incentives to comply with the rules are sometimes outweighed by the apparent profits to be made by breaking them.

Are we trying to guard against greed? We have to guard against aggressive individuals trying to generate large profits.

What are the next danger spots? They always come in new markets in which most people don’t have a lot of experience, and a few clever people figure out how to work the system. Beyond that I couldn’t say.

Recent Posts

People Worry That AI Will Replace Workers. But It Could Make Some More Productive

These scholars say artificial intelligence could help reduce income inequality

A Sentinel for Global Health

AI is promising a better – and faster – way to monitor the world for emerging medical threats

The Age of Deception

AI is generating a disinformation arms race. The window to stop it may be closing