One day last year, Scott Laitinen (BA 1986 UTSC) was looking at a mountain of credit card debt – nearly $80 billion worth. Fortunately, the debt wasn’t his. But the opportunity it presented was.

In other countries, a type of online service called “marketplace lending” has been providing peer-to-peer loans at interest rates below the major cards – enabling people to pay off their credit card debt using a lower-interest marketplace loan. When he realized that the huge Canadian debt represented an opportunity to introduce the concept to this country, Laitinen left the traditional banking world and signed on as Chief Risk Officer at a startup called Borrowell.

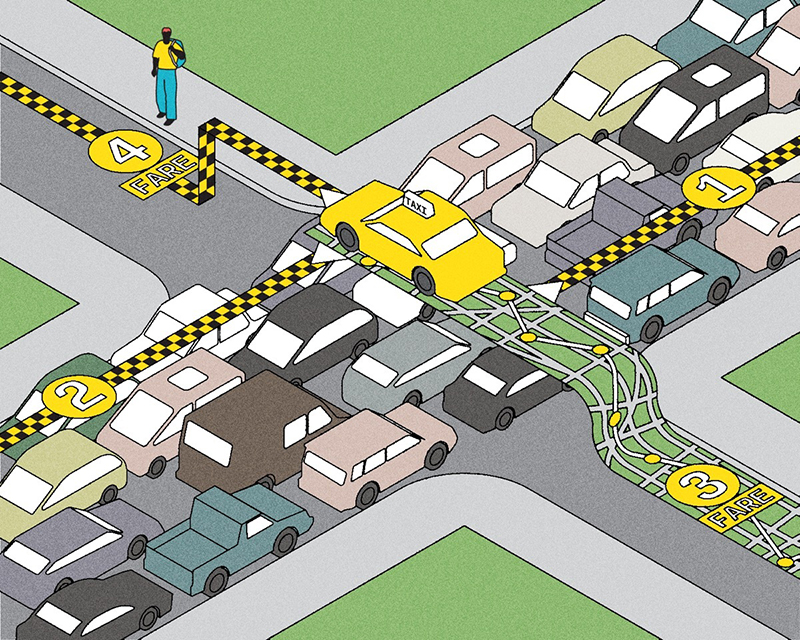

Marketplace lending does not go through a traditional intermediary such as a bank. Companies such as Borrowell run credit checks and verify income data online; borrowers apply for and receive funds via the Internet. Interest rates and borrowing limits are based on credit ratings, with loans ranging from $1,000 to a maximum of $35,000. Interest rates are consistently lower than credit cards – from six to 18 per cent for most borrowers.

And the process is faster. “Even with online banks, you have to go in and sign papers to get a loan,” says Laitinen. “With Borrowell, you get a decision within 60 seconds on whether your loan is approved, and you have the money in your account within two days.”

The company sees a big market in credit card debt consolidation – people with good credit scores, but who are making their minimum payments, living paycheque to paycheque.

The potential of that market allowed Borrowell to catch the attention of the several investment fund companies and private investors who provide the company’s capital. Borrowell began lending in March. Despite lower interest rates and quicker service, Laitinen says the company is still working to overcome borrowers’ skepticism.

“We’ve seen early on some of the perception that online lending is like payday lending,” he says. (So-called “payday loans” usually come with interest rates higher than 20 per cent and serve clients who need cash quickly.) He says Canadians trust their banks. “We’re targeting people who are savvy online. If we capture even one or two per cent of that $80 billion, it makes this business valuable.”

Credit card debt consolidation offers a large potential market for Borrowell, but the company can also serve other loan markets such as home renovation, travel, weddings and even small businesses.

Laitinen, who specialized in management at UTSC and has been working in financial services for 30 years, says the draw of Borrowell wasn’t just potentially lucrative – it also seemed like a social good. “You see headlines about Canadian debt. The great thing with a marketplace loan is it actually can help people get out of debt,” he says.

Watch a presentation by Borrowell’s co-founder and chief operating officer, Eva Wong, at the Toronto Tech Meetup

Recent Posts

People Worry That AI Will Replace Workers. But It Could Make Some More Productive

These scholars say artificial intelligence could help reduce income inequality

A Sentinel for Global Health

AI is promising a better – and faster – way to monitor the world for emerging medical threats

The Age of Deception

AI is generating a disinformation arms race. The window to stop it may be closing