Early one morning in October, Martha Stewart arrived at Alderson, West Virginia, to begin serving a five-month prison sentence for lying to U.S. investigators about a stock transaction. Although her misdeed won’t amount to much more than a footnote in the annals of white collar crime, Stewart has become a potent symbol of what some see as rampant greed in corporate America.

The U.S. is not alone when it comes to troublesome CEOs and corporate transgressions, of course. In Canada, Conrad Black and his senior executives stand accused of fleecing their company, Hollinger Inc., of millions of dollars to fund personal expenses. (For his part, Black says the payments “were justifiable and disclosed by sophisticated and fully informed independent directors.”)

While many may see little distinction between the Marthas and Conrads of the world, their cases offer us different insights into preventing these situations in the future.

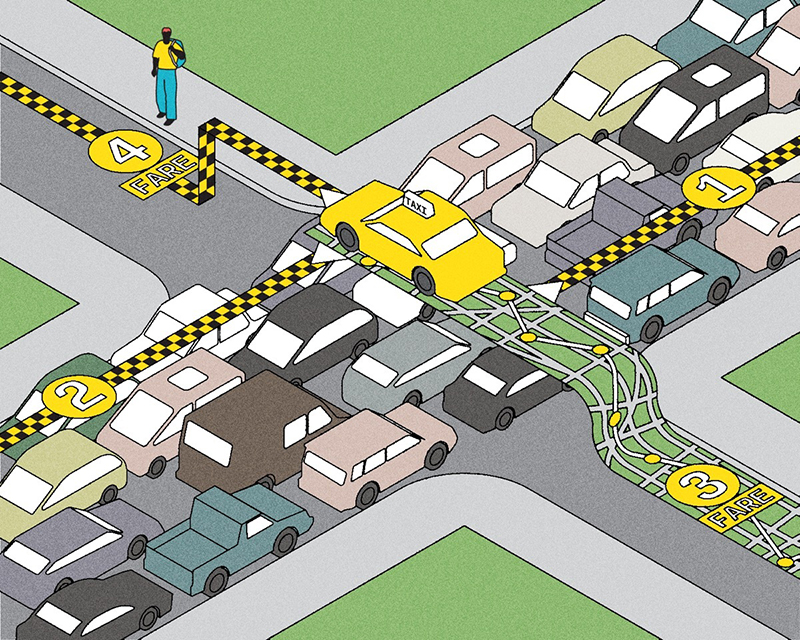

Martha Stewart is said to have sold about 4,000 shares of ImClone – worth approximately $250,000 US – based on insider information. The transaction had nothing to do with her own company, Martha Stewart Living Omnimedia, or her role there as CEO. She used her own money, and only she and her stockbroker were involved in her decision to sell the shares. Martha Stewart Living was affected only when Stewart’s indictment touched off a steep decline in the company’s share price.

The allegations against Conrad Black and his senior executives at Hollinger (and they are only allegations at this point; nothing has been proven in court) involve the use of money that did not belong to them but to all of Hollinger’s shareholders. The distinction is significant: Martha Stewart played with her own money; Conrad Black is said to have played with Hollinger’s.

I don’t think we can do much more than we are already doing to stop the Martha Stewarts of the world. People, for various reasons of self-interest, will inevitably make poor decisions; in some cases, they will get away with them. Stewart’s incarceration sends a clear message that insider trading carries a harsh penalty (at least in the U.S.). It should remind regulators, too, of the need to be vigilant. Strict policing will catch those who intend to defraud our securities system, but we need to continue to invest in enforcement. The Ontario Securities Commission (OSC) has recently announced that it will try to ferret out fraud by using “regulatory intelligence.” With the help of industry watchdogs, OSC investigators will try to identify questionable investment activities. This is a step in the right direction, but the OSC requires stronger enforcement powers, comparable to similar agencies in the United States.

Conrad Black is another story. We can do (and should be doing) a lot more to prevent such alleged corporate abuses. At Hollinger, and at many of the scandal-plagued corporations we’ve been reading about, the board of directors appears to have been nothing more than a rubber stamp. The controlling or majority shareholder seems to have called the shots and the board acquiesced.

At a growing number of companies in North America, this is finally beginning to change. In some cases, shareholders (and in others, regulators) have demanded the appointment of directors who are independent from management and the majority shareholders. On properly constituted boards, a majority of independent directors meet not only with management but on their own as well. While the board requires the input and participation of key management personnel, their decisions reflect what, in their opinion, is best for the company and its shareholders, regardless of management’s view. Large institutional investors such as the Ontario Teachers’ Pension Plan have become more active, demanding more transparent reporting at shareholder meetings and holding directors more accountable for a company’s results.

Important board committees should be composed entirely of independent members. Effective and forward-thinking boards are inviting experts in areas such as compensation to guide them through deliberations. On properly constituted boards, directors can scrutinize management’s actions, ask for further information, and challenge management’s decisions without being hampered by friendships and ill-placed loyalties. While directors are being encouraged to own shares, stock options – the ability to invest should market conditions make it prudent to do so – are being eliminated. Directors, such as those at TD Bank, are now putting themselves in the same position as the average shareholder, rather than a superior one.

I believe that the vast majority of people in business want to do the right thing. But I also believe that as university educators, we have a critical role to play in the development of socially responsible and ethically minded business people.

Most people develop the ability to judge between right and wrong long before they come to university. What we do during grade school and high school – and the feedback we get from our teachers and mentors – reinforces what we think of as fair and unfair, just and unjust, acceptable and unacceptable. I don’t think universities can do much to teach people the difference between right and wrong. But we do have an obligation to provide students with the tools to help them make ethical decisions – often under pressure and with a lot of competing information to distil. And we need to investigate a variety of models of corporate governance to determine which are the most effective under differing circumstances.

A component of every undergraduate business program in Canada now deals with ethical decision-making. At the University of Toronto, entire courses are devoted to the subject. By studying the mistakes of the past, we hope to positively influence the decision-makers of the future. At the MBA and executive MBA levels, the story is the same.

Courses integrating ethics and corporate governance are required components of the curriculum. The Rotman School of Management at the University of Toronto, in conjunction with the ICD Corporate Governance College, has established a unique directors education program to meet the needs of both current and future corporate directors.

Interestingly, Conrad Black is quoted in a recently published book by Richard Siklos (Shades of Black: Conrad Black, His Rise and Fall) stating “I underestimated the force of the corporate governance movement.” Indeed.

Richard C. Powers is a senior lecturer in the Joseph L. Rotman School of Management and vice-chair of the division of management at the University of Toronto at Scarborough.

Recent Posts

People Worry That AI Will Replace Workers. But It Could Make Some More Productive

These scholars say artificial intelligence could help reduce income inequality

A Sentinel for Global Health

AI is promising a better – and faster – way to monitor the world for emerging medical threats

The Age of Deception

AI is generating a disinformation arms race. The window to stop it may be closing

One Response to “ The Lessons of Martha and Conrad ”

Please note that Martha Stewart was never convicted of insider trading. She was jailed for telling a lie to a policeman, something not considered a crime in most civilized societies. The biggest potential threats to our economic well-being are agents of the state like New York state attorney general Eliot Spitzer and Russian president Vladimir Putin, either of whom could do far more damage than a thousand Martha Stewarts.

John Sands

BA 1952 Victoria

Markham, Ontario